Live Price

Bitcoin Price LiveNew

Live streaming of Bitcoin price with other price information.

Market Cycle Charts

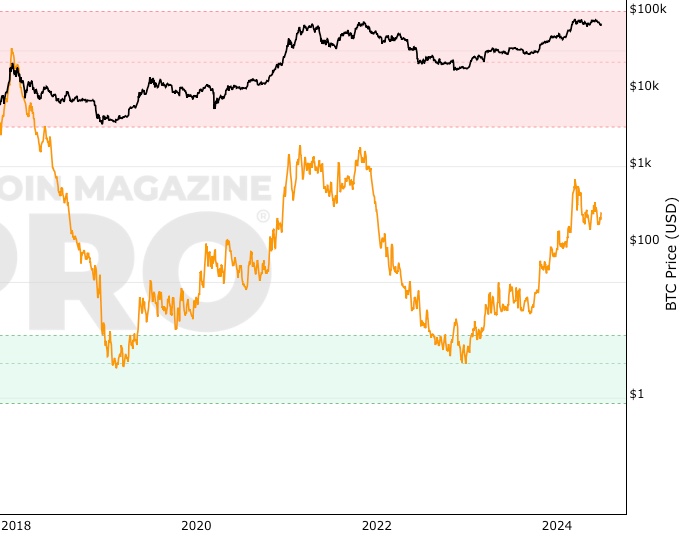

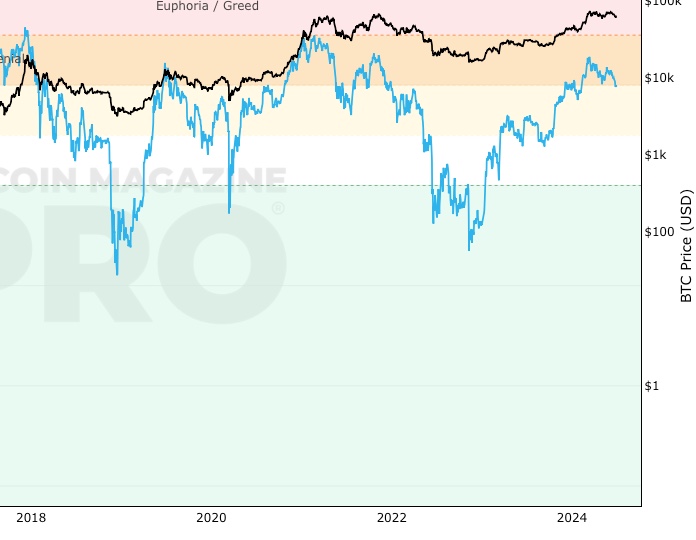

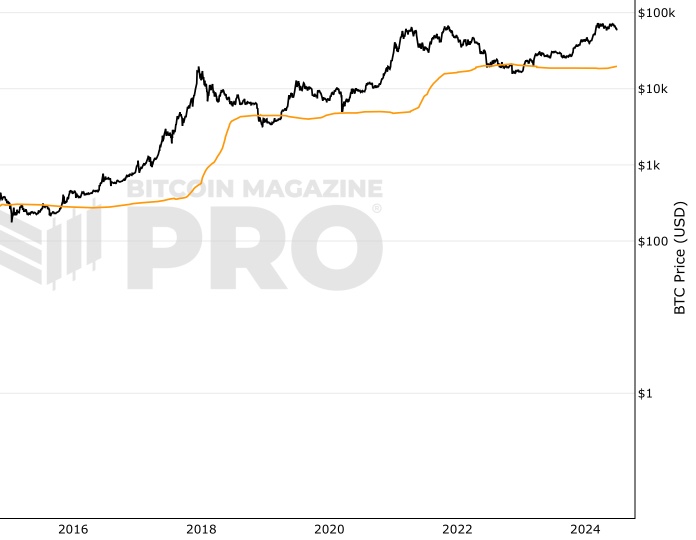

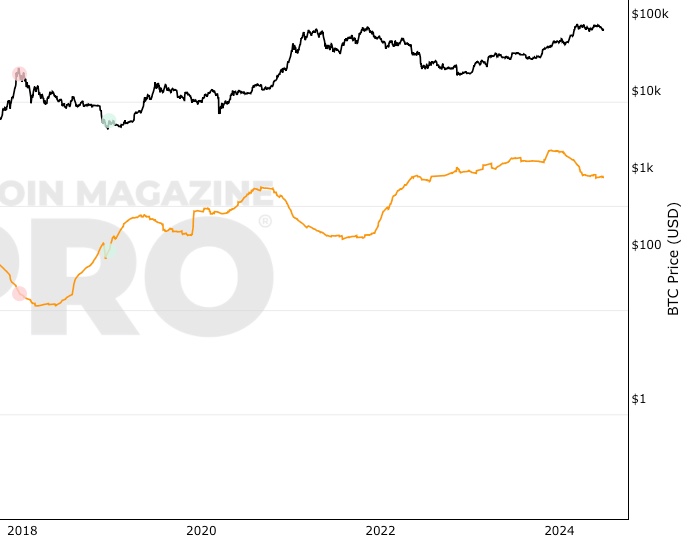

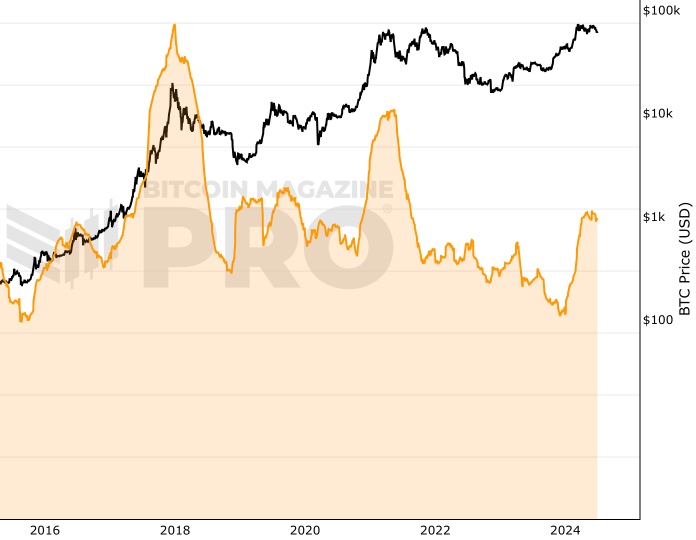

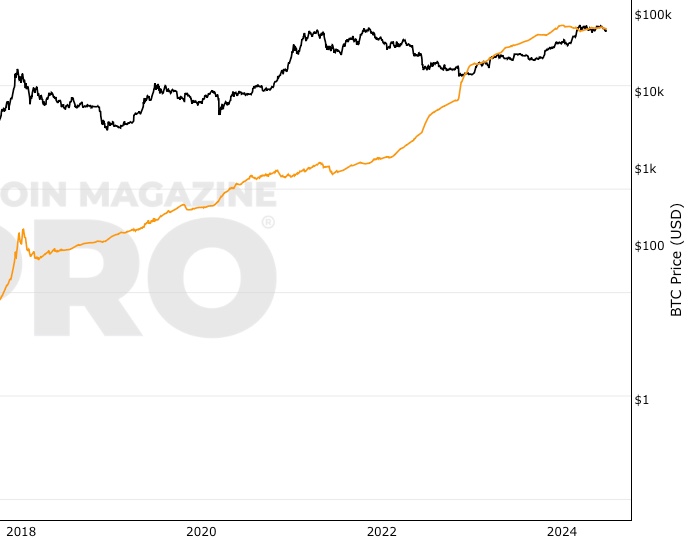

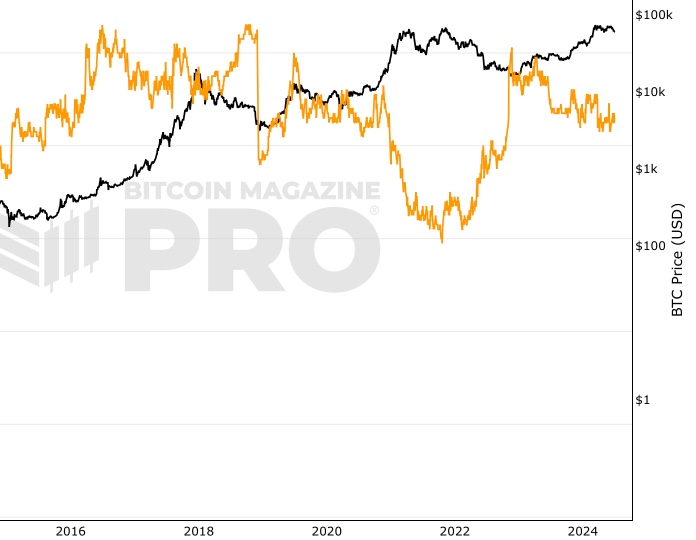

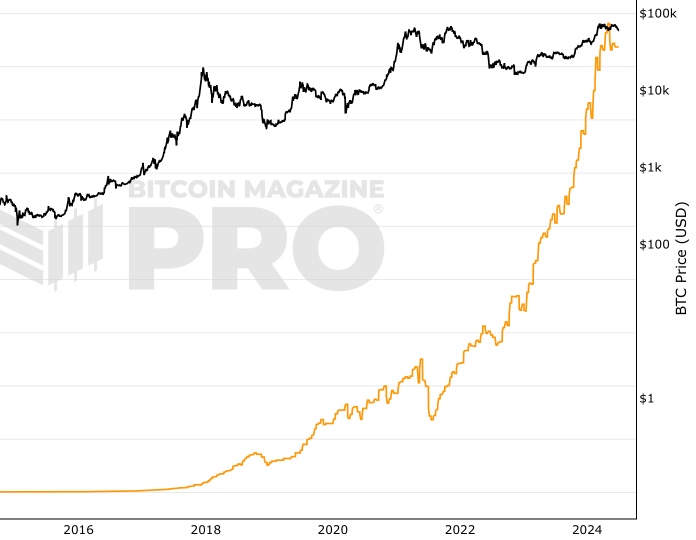

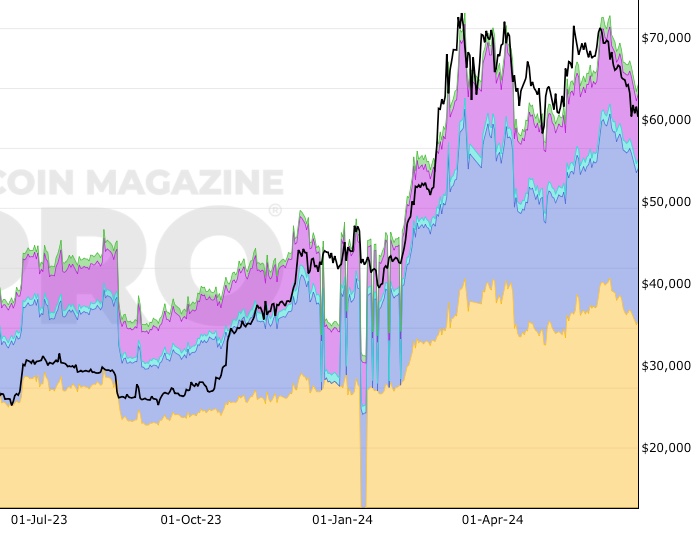

Bitcoin Investor Tool: 2-Year MA Multiplier

Long timeframe investor tool to identify under/oversold price periods

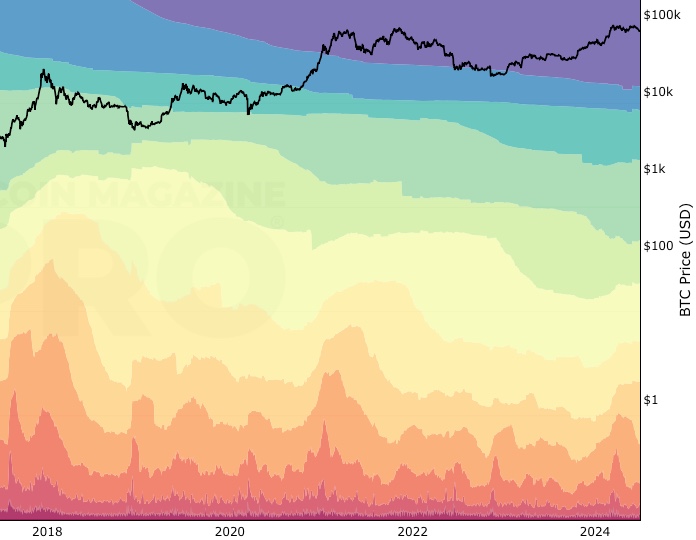

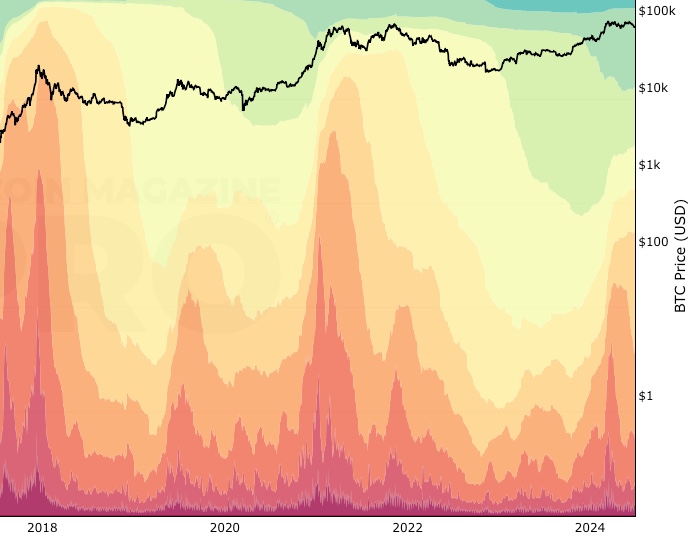

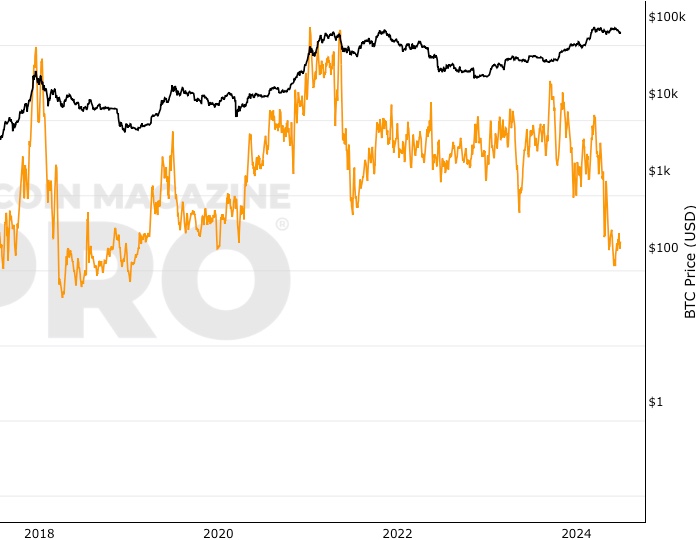

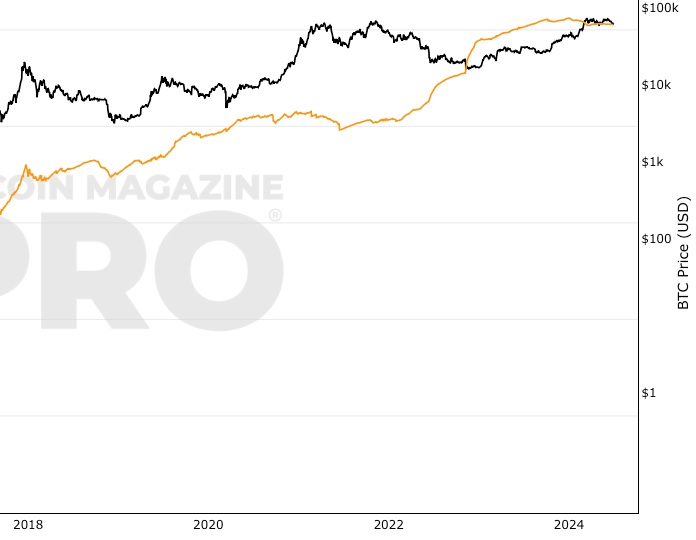

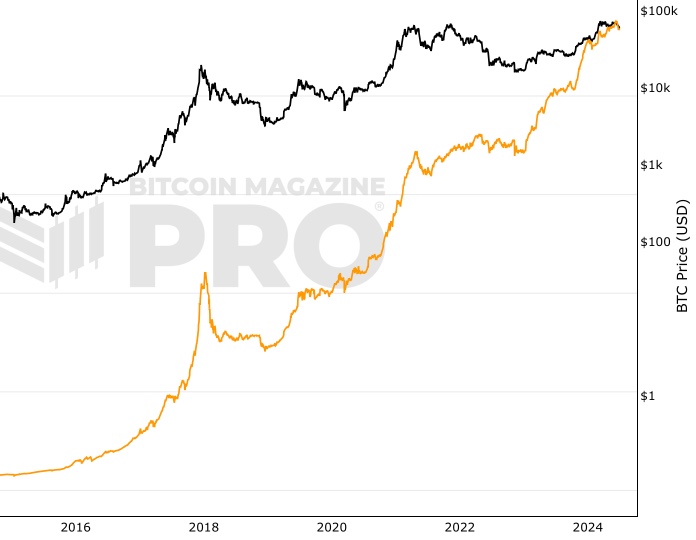

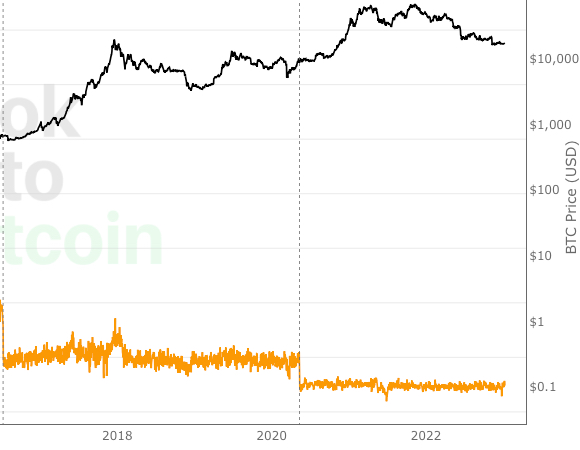

200 Week Moving Average Heatmap

A simple heatmap system based on movements of the 200 week moving average.

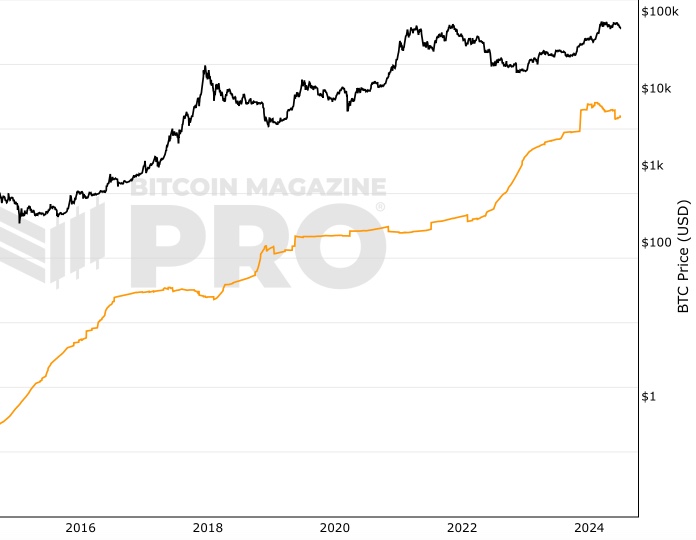

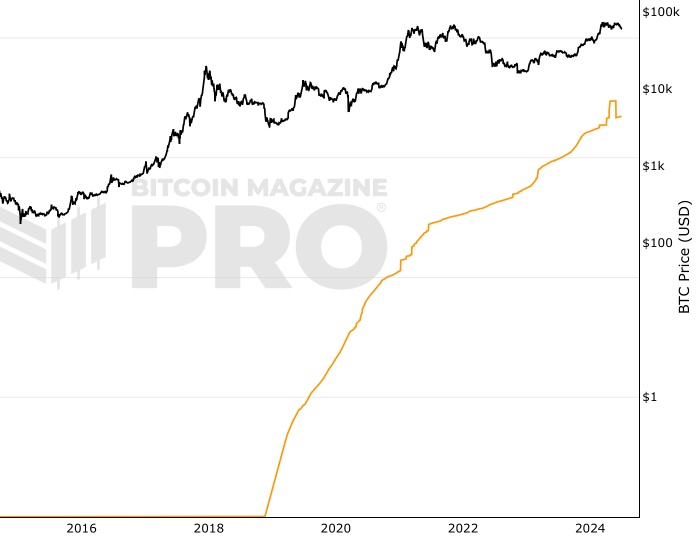

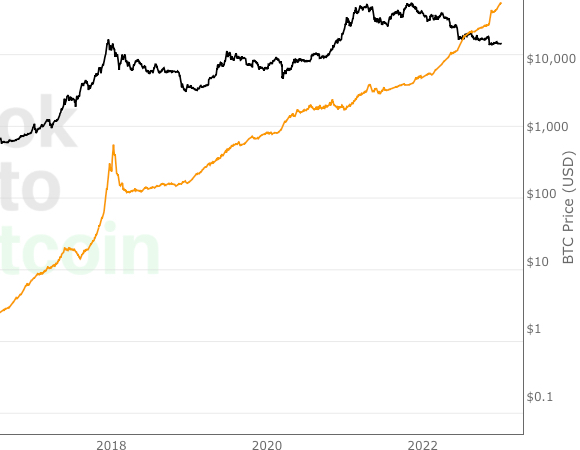

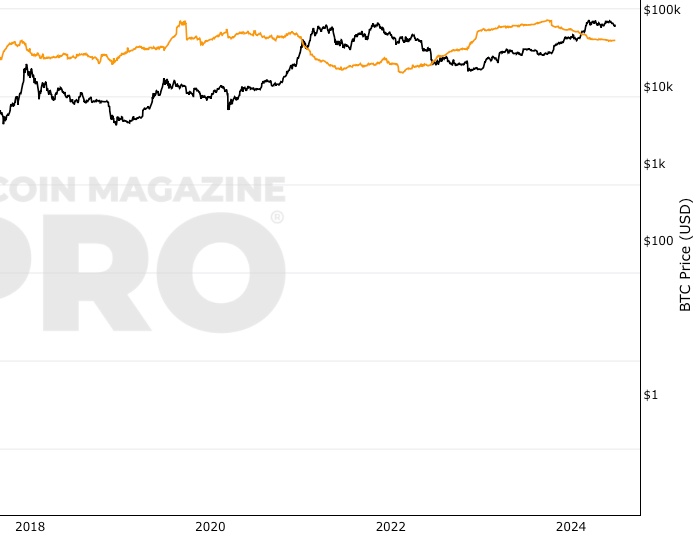

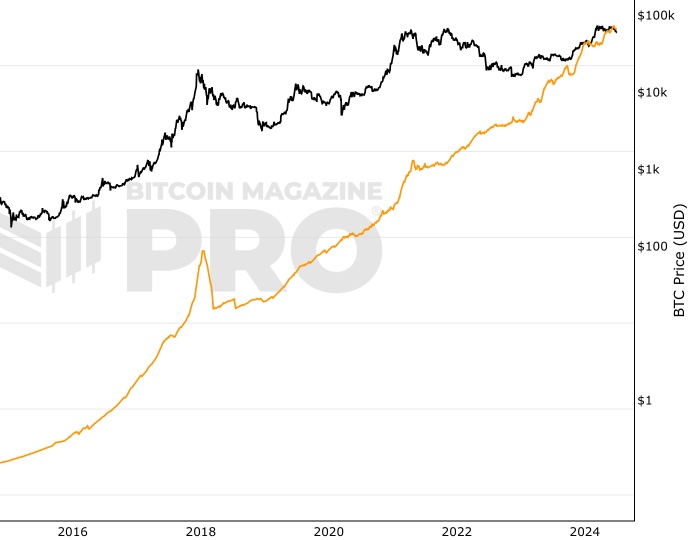

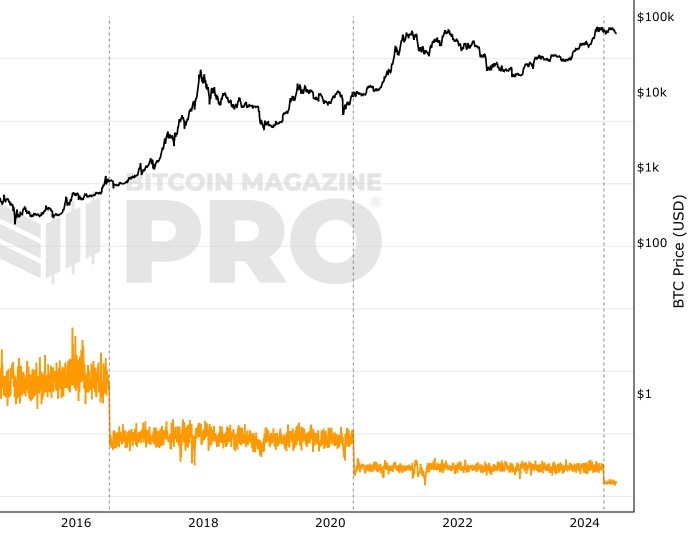

Stock-to-Flow Model

Ratio of bitcoins in circulation relative to the amount of bitcoins annually mined, and this ratio's relationship with price

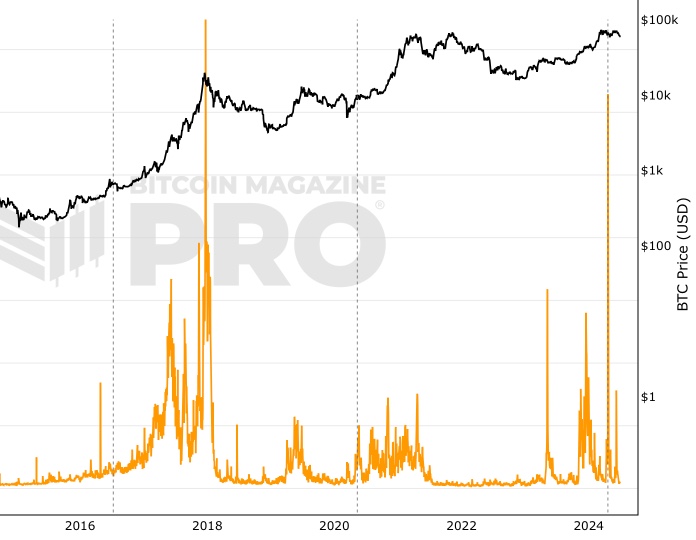

Fear And Greed Index

Market sentiment tool gauging investor fear and greed over time.

Pi Cycle Top Indicator

Moving average and moving average multiples to pick market cycle highs to within 3 days.

The Golden Ratio Multiplier

Uses Bitcoin's growth adoption curve and market cycles to identify both intracycle and full-cycle price highs.

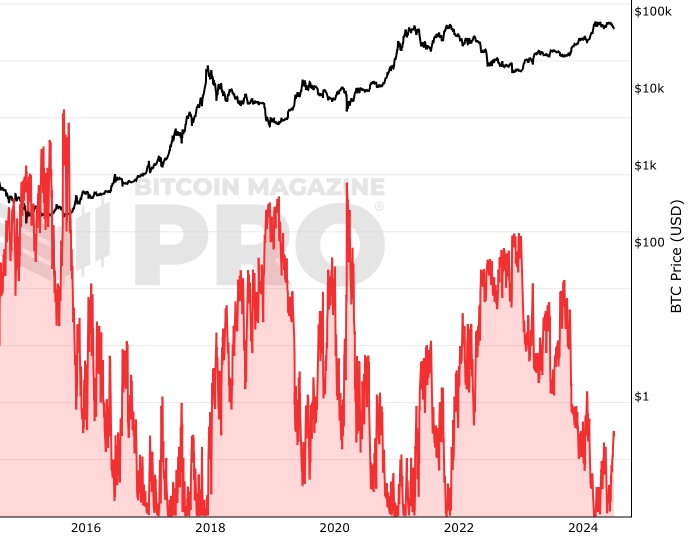

Bitcoin Profitable Days

The proportion of days in Bitcoin's traded history that it has been profitable to hold Bitcoin

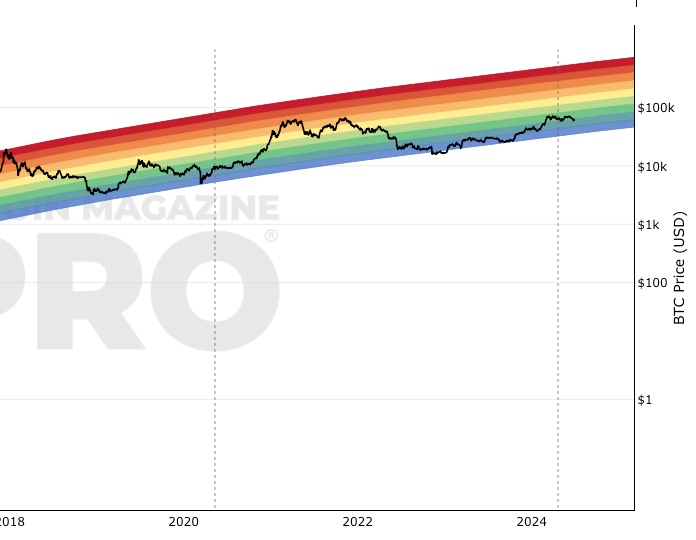

Bitcoin Rainbow Price Chart Indicator

Uses color bands overlaid on a log growth curve to highlight market stages.

Bitcoin Cycle MasterNew

A combination of on-chain metrics including Coin Value Days Destroyed and Terminal Price.

Pi Cycle Top & Bottom IndicatorNew

Pi Cycle Top and Bottom Indicator.

Pi Cycle Top PredictionNew

Predicting when the Pi Cycle Top Indicator will cross.

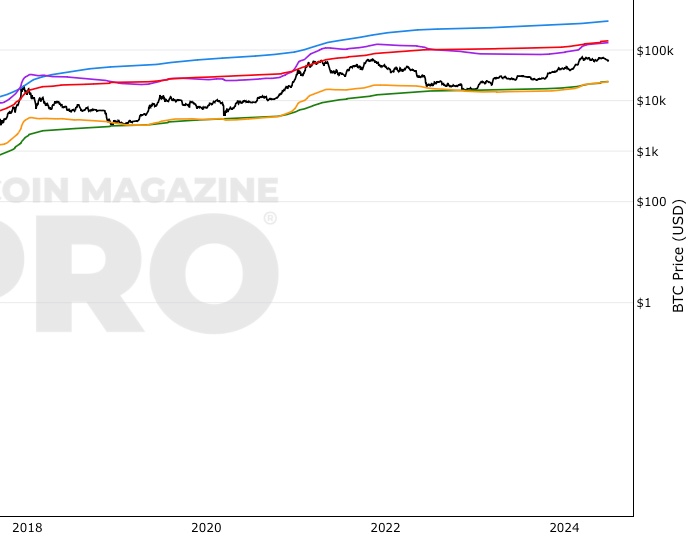

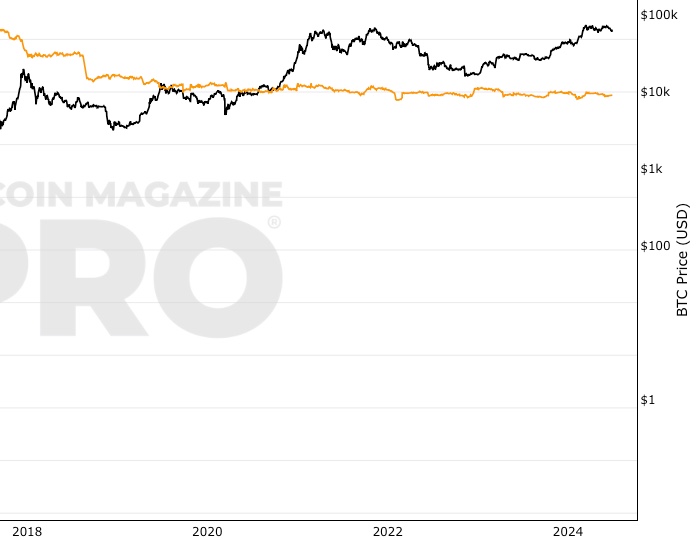

Power LawNew

Bitcoin linear regression model

Onchain Market Indicators

Price Forecast Tools

Top Cap, Terminal Price, Delta Top, CVDD, Balanced Price

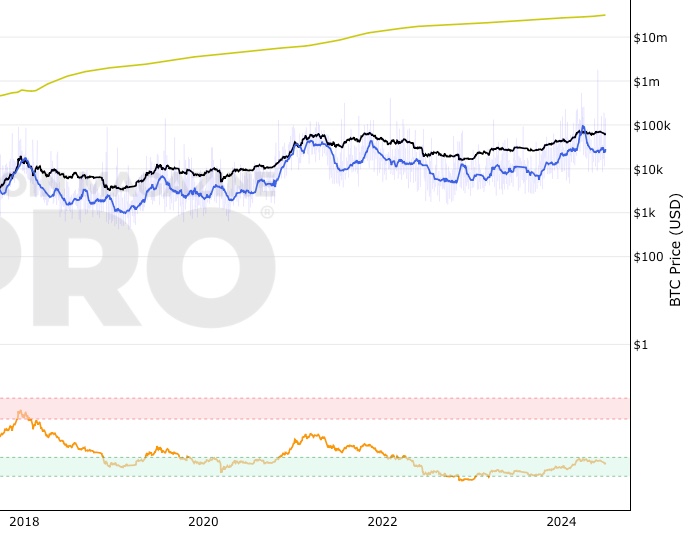

MVRV Z-Score

Pulls apart differences between Market Value and Realised Value to identify market cycle highs and lows.

RHODL Ratio

On Chain Indicator using Realized HODL Ratio’s to identify cycle high price tops.

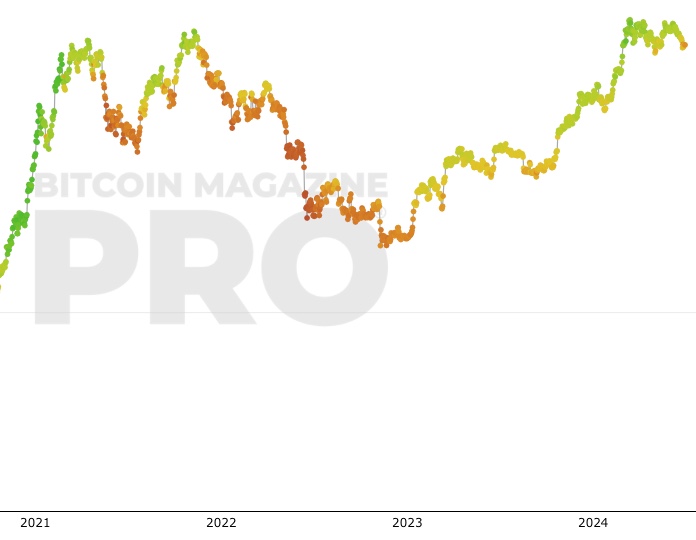

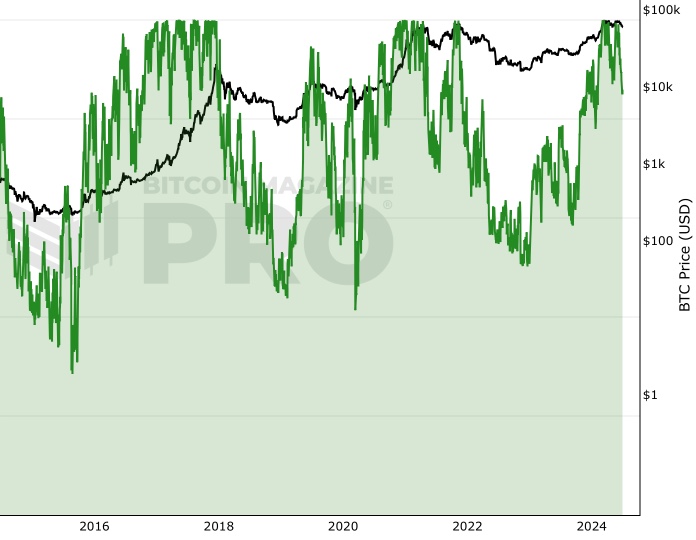

Net Unrealized Profit/Loss (NUPL)

On-chain indicator for investor sentiment market stages

Reserve Risk

Long term Bitcoin investor confidence relative to Bitcoin price.

AASI (Active Address Sentiment Indicator)

Comparing change in price with change in number of addresses to determine if Bitcoin is over/undervalued in the short term.

Advanced NVT Signal

This adaptation of NVT Signal adds standard deviation bands to identify when Bitcoin is overbought or oversold.

Realized Price

The aggregate cost-basis of all bitcoin.

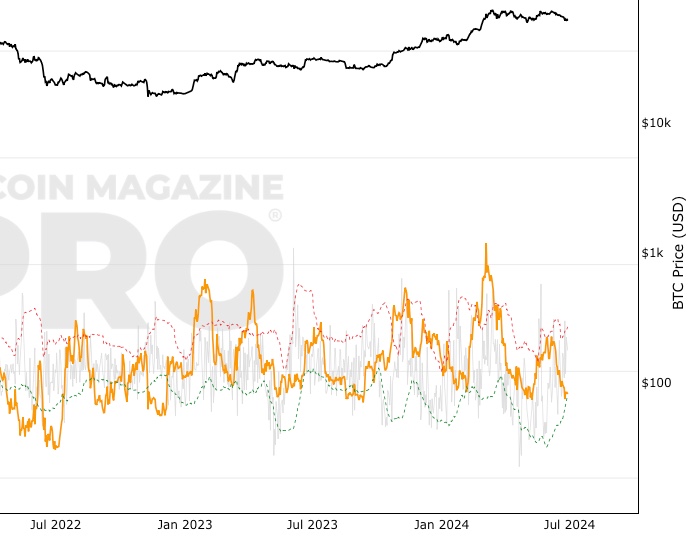

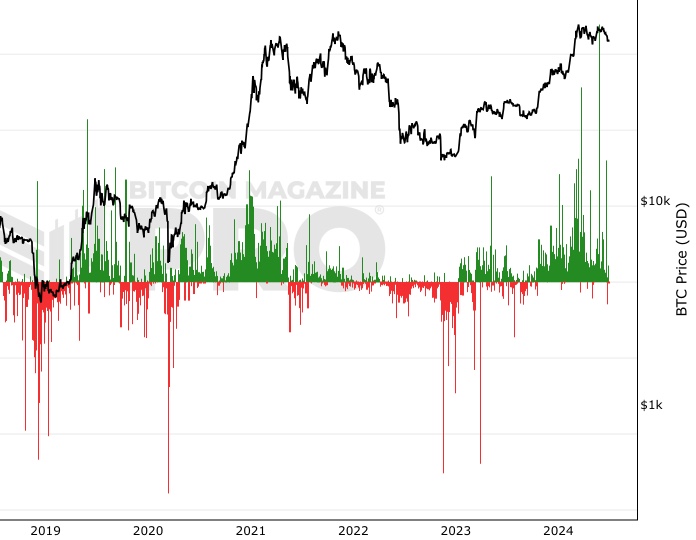

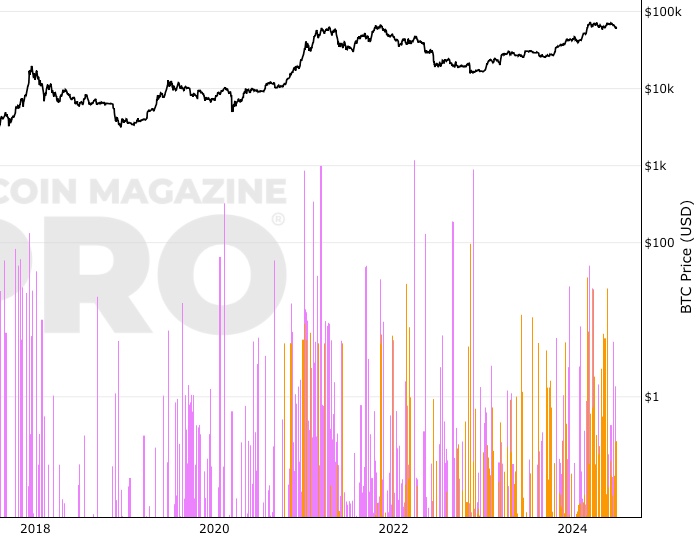

Value Days Destroyed (VDD) Multiple

Identifies Bitcoin cycle highs by comparing near-term spending velocity with yearly average of spending velocity.

CVDD

Pricing model for identifying Bitcoin bear market lows.

Top Cap

Pricing model for identifying Bitcoin bull market highs.

Delta Top

Pricing model for identifying Bitcoin bull market highs.

Balanced Price

Pricing model for identifying Bitcoin bear market lows.

Terminal Price

Pricing model for identifying Bitcoin bull market highs.

Long-Term Holder Realized PriceNew

Average price at which long-term investors have purchased their Bitcoin.

Short-Term Holder Realized PriceNew

Average price at which short-term investors have purchased their Bitcoin.

Percent Addresses in ProfitNew

The Percentage of Bitcoin Addresses in Profit.

Percent Addresses in LossNew

The Percentage of Bitcoin Addresses in Loss

Spent Output Profit Ratio (SOPR)New

SOPR tracks the profit margin of all moved bitcoins in a given time period.

Short Term Holder MVRVNew

MVRV focussing on short-term investors.

Short Term Holder MVRV Z-ScoreNew

MVRV Z-Score focussing on short-term investors.

Long Term Holder MVRVNew

MVRV Z-Score focussing on long-term investors.

Long Term Holder MVRV Z-ScoreNew

MVRV Z-Score focussing on short-term investors.

MVRV Z-Score 2YR Rolling

An adaptation of MVRV Z-Score with an emphasis on recent historical data.

Everything IndicatorNew

This indicator consolidates multiple metrics into one score to provide a comprehensive market overview.

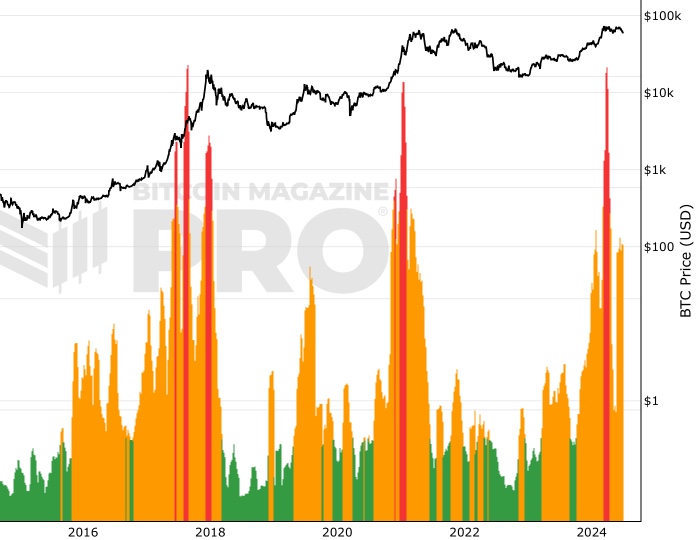

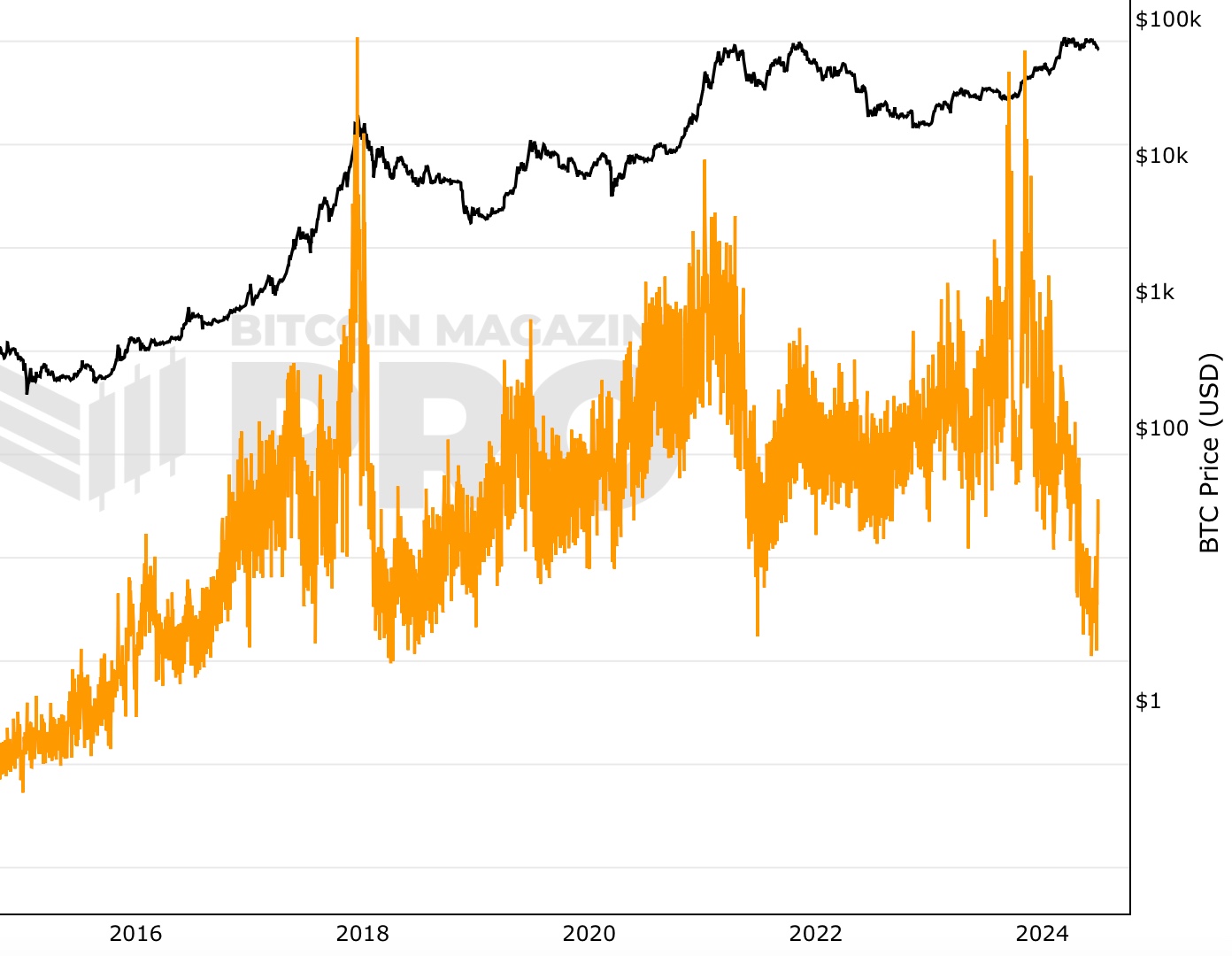

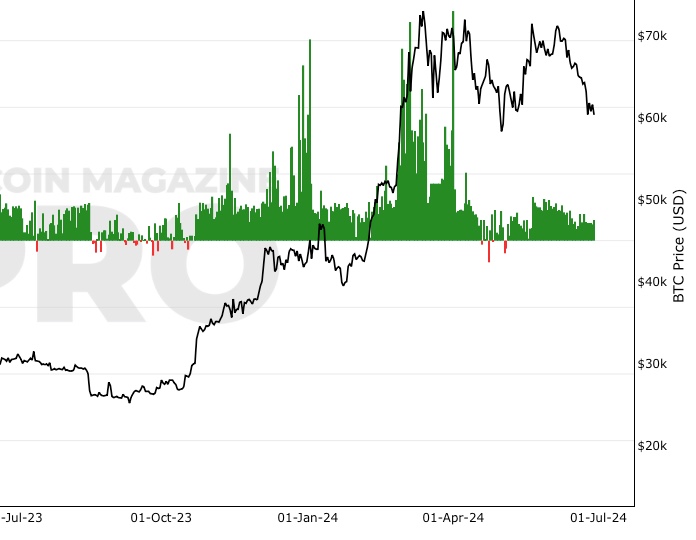

Puell Multiple

Relationship between daily bitcoin issuance and price.

Onchain Movement Charts

HODL Waves

Percentage of bitcoins that have last moved on-chain within specific time frames.

1+ Year HODL Wave

View of the percentage of coins HODL'd on the blockchain for over 1 year.

5+ Years HODL Wave

Bitcoin 5+ year HODL wave chart, showing percentage of bitcoin that has not moved onchain for 5+ years.

10+ Years HODL Wave

Bitcoin 10+ year HODL wave chart, showing percentage of bitcoin that has not moved onchain for 10+ years.

Realized Cap HODL Waves

The cost basis of UTXO’s held within specific age bands.

Whale Shadows (aka Revived Supply)

Onchain tracking of old coins moving again in large amounts.

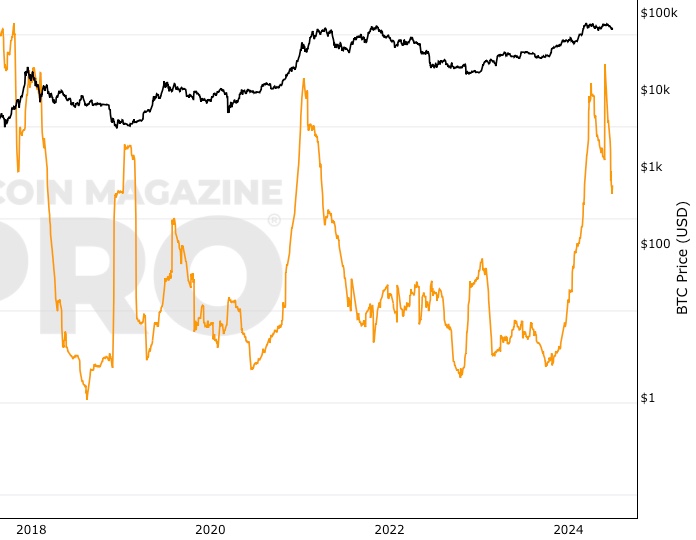

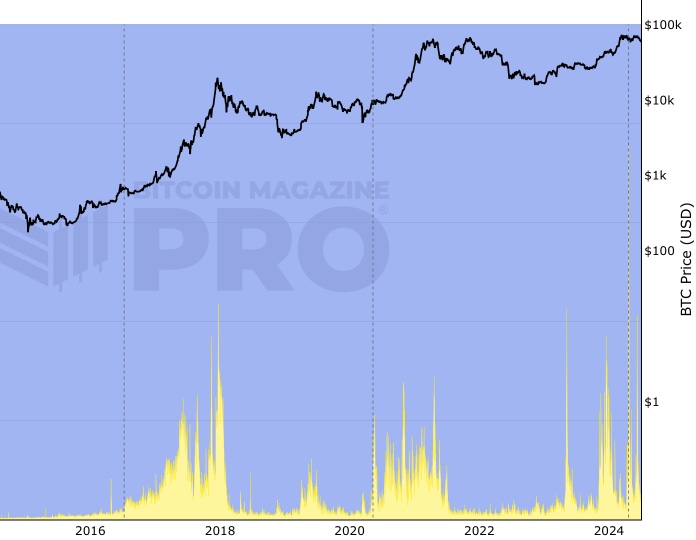

Coin Days Destroyed

Number of coins multiplied by days since those coins last moved on-chain.

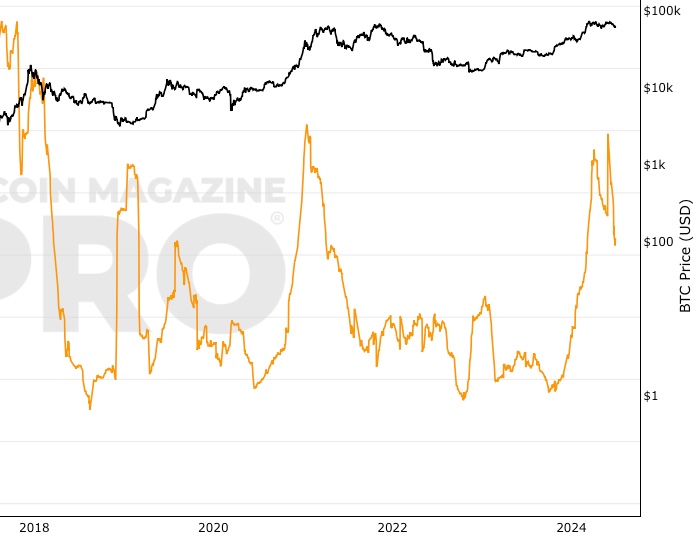

Supply Adjusted Coin Days Destroyed

Number of coins multiplied by days since those coins last moved on-chain, adjusted for bitcoin supply.

Long Term Holder SupplyNew

Circulating bitcoin supply that is held by long term holders.

Short Term Holder SupplyNew

Circulating bitcoin supply that is held by short term holders.

Circulating SupplyNew

Number of bitcoins already in circulation.

Address Balance Charts

Bitcoin Active Addresses

The number of Bitcoin Active Addresses.

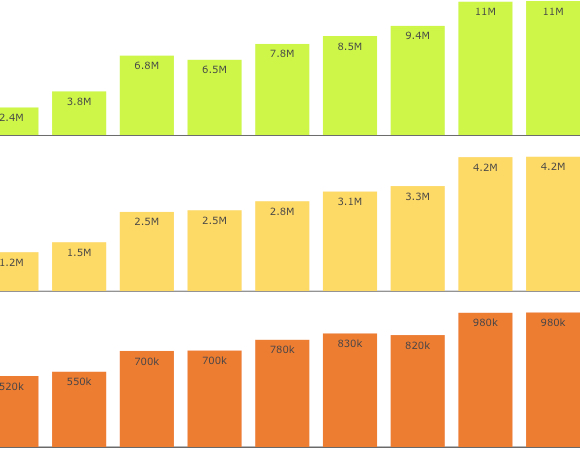

Addresses Holding > X BTC by Year

Addresses holding x btc by year.

Addresses with Balance > 0.01 BTC

Live chart showing the number of unique addresses holding at least 0.01 BTC.

Addresses with Balance > 0.1 BTC

Live chart showing the number of unique addresses holding at least 0.1 BTC.

Addresses with Balance > 1 BTC

Live chart showing the number of unique addresses holding at least 1 BTC.

Addresses with Balance > 10 BTC

Live chart showing the number of unique addresses holding at least 10 BTC.

Addresses with Balance > 100 BTC

Live chart showing the number of unique addresses holding at least 100 BTC.

Addresses with Balance > 1,000 BTC

Live chart showing the number of unique addresses holding at least 1,000 BTC.

Addresses with Balance > 10,000 BTCNew

Live chart showing the number of unique addresses holding at least 10,000 BTC.

Addresses with Balance > $1New

Live chart showing the number of unique addresses holding at least $1.

Addresses with Balance > $10New

Live chart showing the number of unique addresses holding at least $10.

Addresses with Balance > $100New

Live chart showing the number of unique addresses holding at least $100.

Addresses with Balance > $1kNew

Live chart showing the number of unique addresses holding at least $1k.

Addresses with Balance > $10kNew

Live chart showing the number of unique addresses holding at least $10k

Addresses with Balance > $100kNew

Live chart showing the number of unique addresses holding at least $100k.

Addresses with Balance > $1mNew

Live chart showing the number of unique addresses holding at least $1m.

Addresses with Non Zero BalanceNew

Live chart showing the number of unique non zero addresses.

Number of New AddressesNew

The number of unique addresses that appeared for the first time in a transaction on the Bitcoin network.

Mining Charts

The Puell Multiple

Relationship between daily bitcoin issuance and price.

Bitcoin Hashrate

Bitcoin network hashrate.

Hash Ribbons Indicator

Hash Ribbons Indicator: Highlights miner capitulation to identify major price lows.

Bitcoin Miner Difficulty

Changes in Bitcoin mining difficulty over time.

Miner Revenue (Total)

Total Bitcoin miner revenue: fees + mining reward.

Miner Revenue (Block Rewards)

Bitcoin miner revenues earned from block rewards.

Miner Revenue (Fees)

Bitcoin miner revenues earned from fees.

Miner Revenue (Fees vs Rewards)

Percentage comparison of Bitcoin miner revenues earned from fees and mining rewards.

Block HeightNew

Total number of blocks in the Bitcoin blockchain.

Blocks MinedNew

Number of blocks mined per day.

HashpriceNew

Miner earnings from specific amounts of power.

Hashprice VolatilityNew

30-day 60-day, 90-day volatility of Hashprice.

Lightning Network Charts

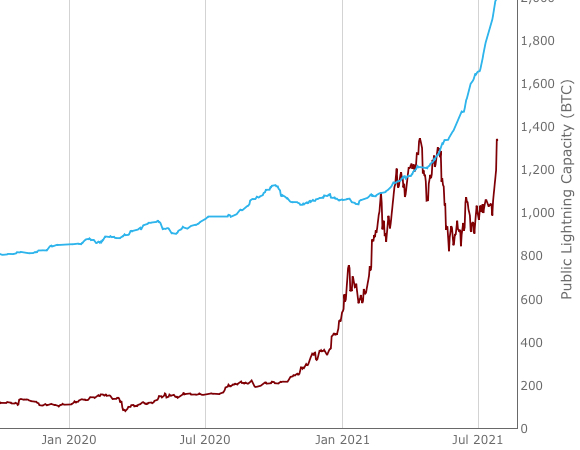

Bitcoin Lightning Capacity

Cumulative capacity held by all nodes on the Lightning Network.

Bitcoin Lightning Nodes

Total number of Bitcoin Lightning nodes.

Derivatives Charts

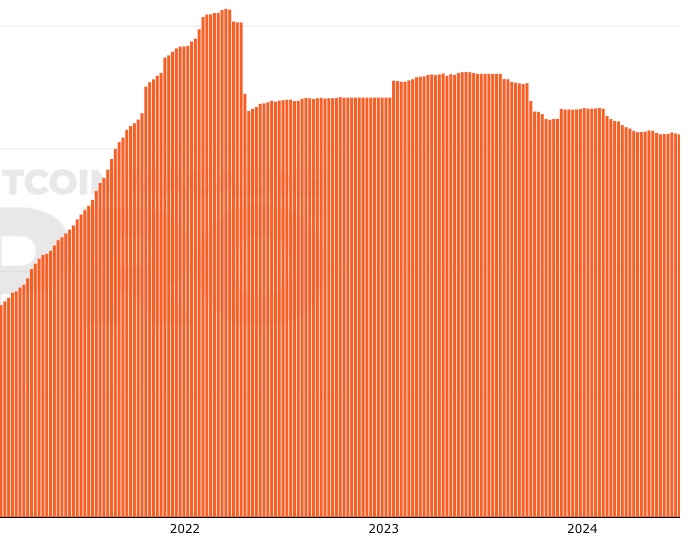

Bitcoin Open Interest

Value of open derivative contracts.

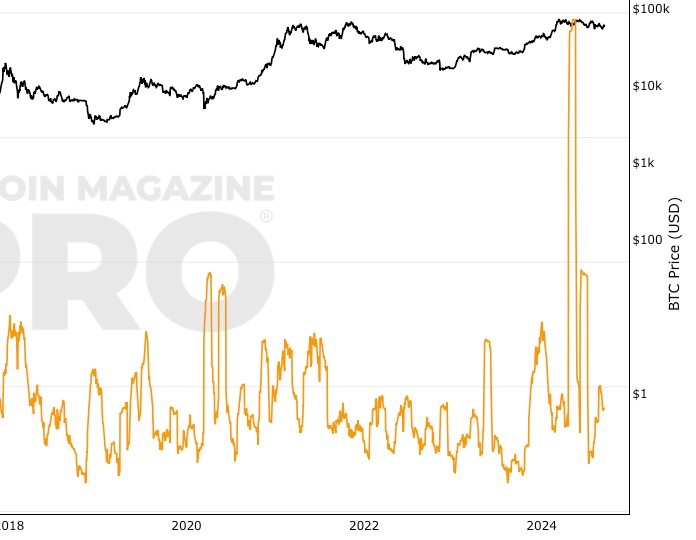

Bitcoin Funding Rates

Perpetual contract funding rates.

Please note, the indicators above are experimental. There is no guarantee certain rules within each model will continue to apply as Bitcoin progresses along its adoption journey. Any information on this site is not to be considered financial advice. Please review the Disclaimer section for more information.