Bitcoin: 1+ Year HODL Wave

Bitcoin: 1+ Year HODL Wave

Zoom in with touchscreen: Touch and hold with ONE finger then drag.

Zoom in on desktop: Left click and drag.

Reset: Double click.

This chart is part of the On-Chain Introduction Collection, tailored for those new to Bitcoin on-chain analytics who want to learn about key metrics.

You can explore and learn about the next chart in the On-Chain Introduction Collection by clicking here.

Indicator Overview

1Y+ HODL Wave builds on work initially conducted by Unchained Capital.

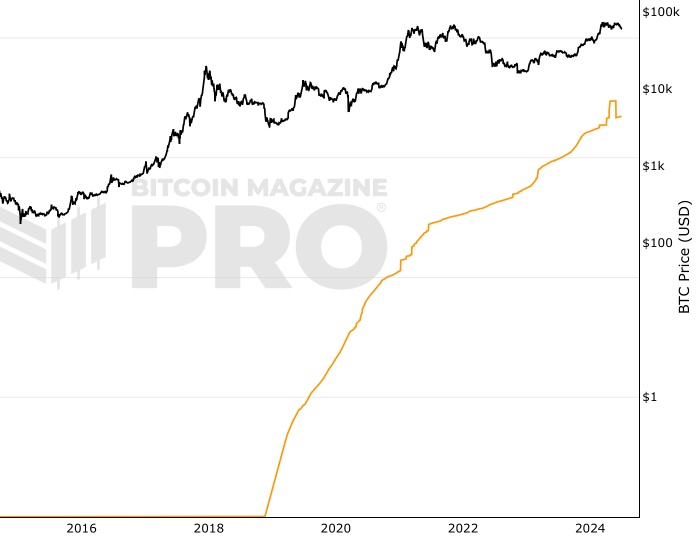

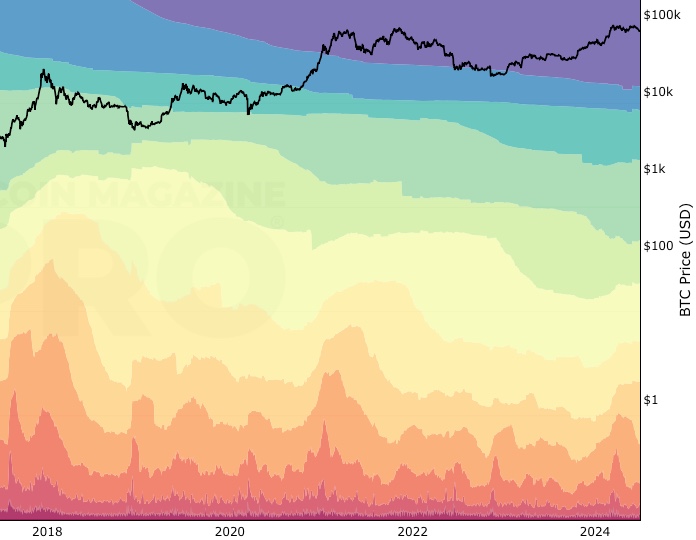

HODL Wave data groups bitcoin by age since it was last moved from one wallet to another.

In this example we are looking at the percentage of all bitcoins that have not been moved from one wallet to another for at least 1 year.

This is a good example of blockchain analysis as we are looking at blockchain data to identify when bitcoins were last sent.

How To Use This Indicator

Looking at this specific 'age' is useful as certain movements in the percentage of 1yr HODL coins coincides with market cycle highs and lows of Bitcoin's price. The reasons for this are driven by market psychology i.e. the emotions of people holding the coins and deciding whether to sell or hold them, depending on where we are in the market cycle.

For example, we can see the proportion of 1yr+ coins decreases as price climbs up towards a new cycle high. This is, in part, due to people who have been holding onto coins for over 1 year deciding to cash in some profit, so they sell the coins and those coins are no longer classified in this analysis as 1yr+. Therefore the 1yr+ HODL (orange line) drops as price (blue line) increases.

Bitcoin Price Prediction Using This Tool

This tool analyzes a group of market participants over time to understand their behavior and identify their potential impact on Bitcoin price. In previous years we have seen that when long-term holders of Bitcoin move their coins en-masse (largely to realize their profits by selling them), it can forecast Bitcoin price reaching its major highs.

Created By

The original HODL waves concept was developed by Unchained Capital .

This specific view was created by Philip Swift .

Date Created

April 2019

Fall Further Down The Rabbit Hole

Similar Live Charts That You May Find Useful

Another live chart that looks at the extent to which groups of market participants are holding their coins vs. selling them is the RHODL Ratio live chart. The full HODL Waves live chart is also available.

You May Also Be Interested In

Long Term Holder Supply

Circulating bitcoin supply that is held by long term holders.

10+ Years HODL Wave

Bitcoin 10+ year HODL wave chart, showing percentage of bitcoin that has not moved onchain for 10+ years.

HODL Waves

Percentage of bitcoins that have last moved on-chain within specific time frames.

Make smarter decisions about Bitcoin. Instantly.

Access the Bitcoin and Global Macro Charts that really drive Bitcoin’s price.

+40 chart alerts. Never miss critical levels on charts again.

Analysis newsletter. Manage your emotions at market extremes.

Private Tradingview indicators. See Bitcoin chart levels in real time!

Cancel anytime.

Any information on this site is not to be considered as financial advice. Please review the Disclaimer section for more information.