Three Charts Showing Why Bitcoin Looks Undervalued Right Now

Jan. 5, 2026

Author: Bitcoin Magazine Pro Team

What’s Happening

Price Action

Bitcoin has been rallying higher into the new year. BTC is up +5.12% over the last week and is now at $92,345.

Figure 1: BTC having a positive week.

It has successfully pulled away from the support level we highlighted back in December when BTC was falling from $100k. That support level held once price reached it and BTC is now pulling up towards a potential resistance zone around $95k - formed by the reversal candle of 15th November. Beyond that is the more challenging resistance area of $100,000 - $105,0000 at and just above the 1yr moving average.

Figure 2: BTC past week.

The Big Story: Three Charts Showing Why Bitcoin Looks Undervalued Right Now

The end of 2025 was disappointing for many in the Bitcoin market. After strong expectations earlier in the year, BTC underperformed and fell back below $100,000. However, as we move into the new year, several key indicators suggest there may be more reason for optimism than the price action alone implies.

Below are three charts that point to Bitcoin being undervalued at current levels. For deeper insights and real-time data, BM Pro subscribers get full access to these metrics and many more. Sign up here.

Chart 1: Funding Rates

In November and December, as Bitcoin lost its 1-year moving average and dropped below $100k, funding rates turned negative (red bars on the charts). This typically occurs during periods of panic, when derivatives traders expect further downside and position defensively by hedging or going short.

Figure 3: Bitcoin Funding Rates.

Historically, negative funding rates tend to appear closer to market lows rather than tops. Importantly, there is currently little sign of excessive leverage or exuberance — conditions that often precede major drawdowns. This creates a more constructive setup for price to recover.

Chart 2: Fear & Greed Index

The market has experienced several consecutive weeks of “Fear” on the Fear & Greed Index, reflecting deeply pessimistic sentiment. In Bitcoin’s history, sustained fear has often coincided with inflection points rather than prolonged declines.

Figure 4: Fear & Greed Index.

With expectations already skewed toward lower prices, even modest positive catalysts can trigger a reversal. Bitcoin’s rebound from ~$80k to ~$93k may be an early signal of this shift.

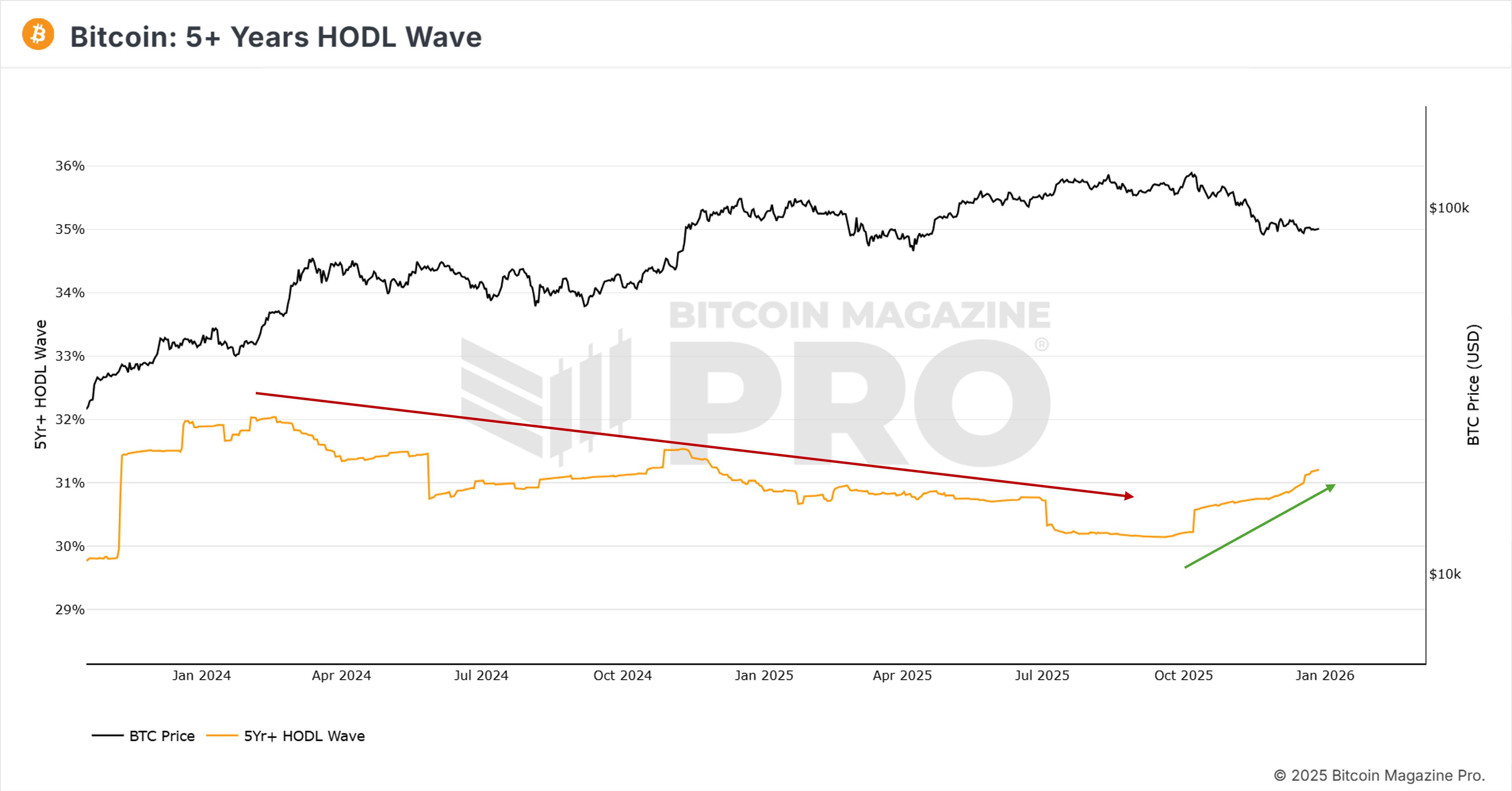

Chart 3: Long-Term HODLer Behaviour

One of the most encouraging signals is that long-term holders appear to have stopped selling. Their distribution was a major driver of Bitcoin’s drawdown in the second half of last year.

Figure 5: +5yr HODL Wave.

The 5-year HODL wave shows this clearly. The orange line has started trending higher again, indicating renewed accumulation by long-term holders. This reduces sell-side pressure and creates a healthier supply backdrop when demand returns.

Conclusion

While short-term volatility remains, sentiment, positioning, and long-term holder behaviour all suggest Bitcoin may be undervalued at current levels. Periods like this have historically offered strong risk-reward opportunities for patient investors. As always, understanding the data beneath the price is key — and that’s where BM Pro gives you the edge. Sign up here.

Wishing you a great start to 2026!

The Bitcoin Magazine Pro Team.

Any information on this site is not to be considered as financial advice. Please review the Disclaimer section for more information.